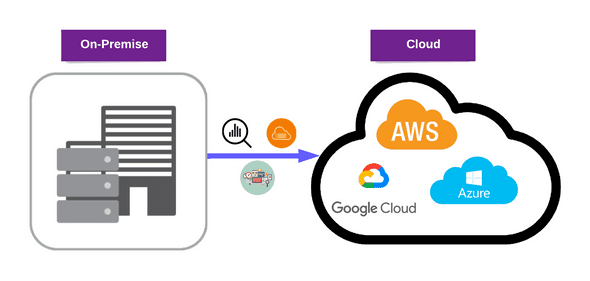

In the dynamic world of cloud computing, simply migrating to AWS is just the first step. As businesses scale their operations on the cloud, managing costs effectively becomes paramount. This is where FinOps comes into play – a practice that bridges the gap between finance and operations, ensuring that organizations can maximize business value from their cloud spend.

For AWS users, FinOps isn’t just a buzzword; it’s a strategic imperative.

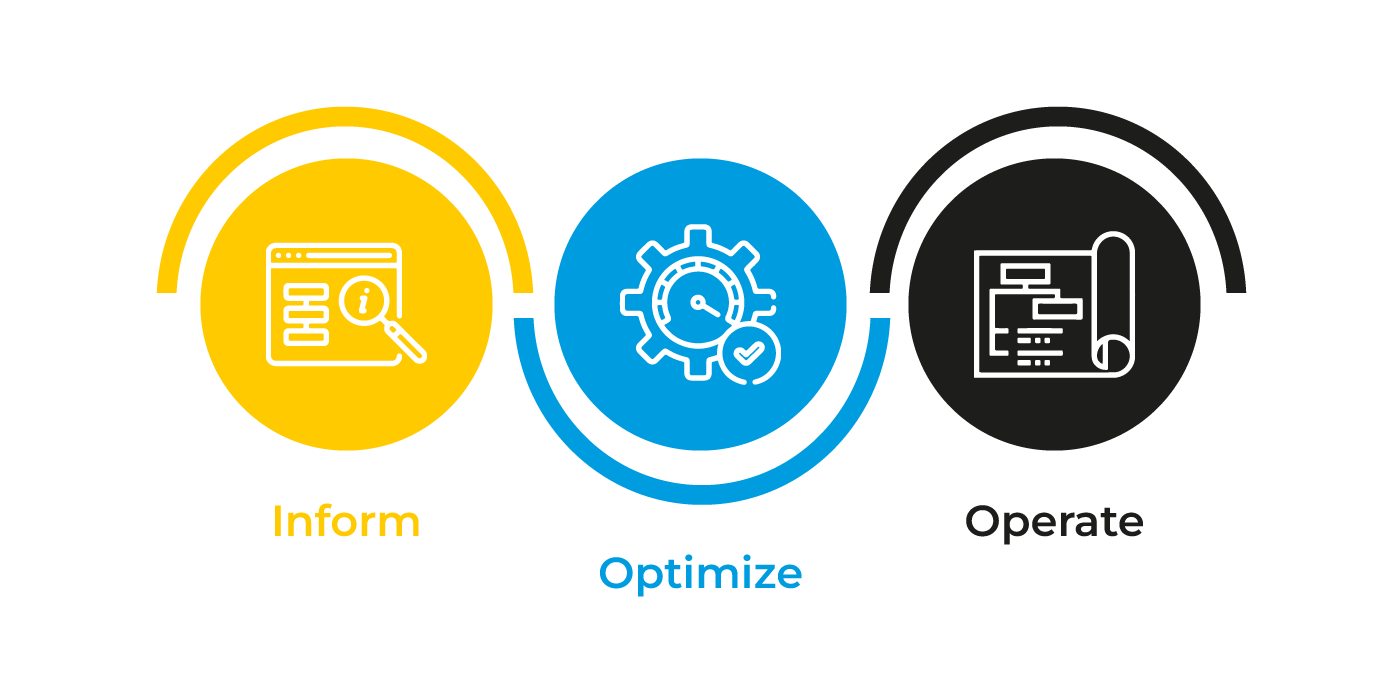

What is FinOps? The Nexus of Finance and Cloud Operations

FinOps is an evolving operational framework and cultural practice that brings financial accountability to the variable spend model of the cloud. It enables organizations to get the most value out of their cloud investments by bringing technology, finance, and business teams together with a new set of processes. Think of it as DevOps for your cloud spending.

In an AWS environment, where resources can be provisioned and de-provisioned in minutes, understanding, controlling, and optimizing costs is crucial. FinOps provides the framework to do just that.

Why FinOps is Crucial for Your AWS Journey

Without a robust FinOps practice, AWS costs can quickly spiral out of control, leading to budget overruns and reduced ROI. Here’s why it’s essential:

- Variable Costs: Unlike traditional on-premise infrastructure with fixed costs, AWS charges are variable and depend on usage. FinOps helps manage this variability.

- Scalability = Cost Complexity: The ease of scaling in AWS means resources can be spun up rapidly, often without immediate cost visibility or accountability.

- Optimization Opportunities: AWS offers numerous ways to optimize costs (e.g., rightsizing, purchasing commitments), but without dedicated effort, these opportunities are often missed.

- Business Value Alignment: FinOps ensures that cloud spending is aligned with business goals, preventing wasteful expenditure and maximizing the value derived from every dollar spent.

Key Pillars of FinOps in AWS

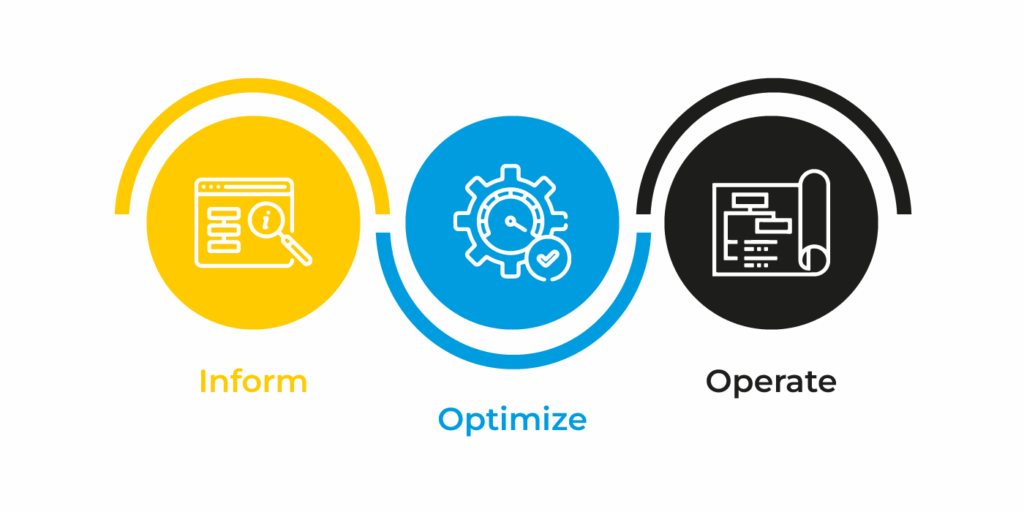

Implementing FinOps in your AWS environment involves several core practices:

1. Cost Visibility and Allocation: Knowing Where Your Money Goes

The first step in controlling costs is understanding them. AWS provides a wealth of data through services like AWS Cost Explorer, AWS Budgets, and AWS Billing and Cost Management.

- Granular Tagging: Implement a robust tagging strategy for all your AWS resources. This allows you to categorize costs by team, project, environment, application, or business unit.

- Cost and Usage Reports (CUR): Utilize CUR to get detailed insights into your AWS spend, down to the hour or even second.

- Cost Allocation Tags: Use custom tags to allocate shared costs effectively across different departments or projects.

- Dashboards and Reporting: Build custom dashboards using AWS QuickSight or third-party tools to visualize spending trends and identify anomalies.

2. Cost Optimization: Doing More with Less

Once you have visibility, the next step is to actively reduce waste and optimize usage.

- Rightsizing: Regularly analyze resource utilization (CPU, memory, network I/O) and resize EC2 instances, RDS databases, and other services to match actual needs, avoiding over-provisioning. AWS Compute Optimizer can help with this.

- Reserved Instances (RIs) & Savings Plans: Commit to a certain level of usage over a 1-year or 3-year term for significant discounts on EC2, Fargate, Lambda, and more. This is ideal for predictable, steady-state workloads.

- Spot Instances: Leverage spare AWS EC2 capacity for fault-tolerant workloads (e.g., batch processing, data analysis) at drastically reduced prices.

- Eliminate Waste: Identify and terminate idle resources (e.g., unattached EBS volumes, old snapshots, unused EC2 instances) that are still incurring costs.

- Storage Optimization: Use S3 Intelligent-Tiering, lifecycle policies, and appropriate storage classes to optimize storage costs based on data access patterns.

- Serverless First: Consider AWS Lambda, Fargate, and other serverless options for applications where possible, as they only charge for actual execution time.

3. Automation: Streamlining Cost Management

Automating FinOps practices can significantly improve efficiency and consistency.

- Automated Rightsizing: Implement scripts or use AWS services to automatically rightsizing resources based on predefined thresholds.

- Scheduled Start/Stop: For non-production environments (dev, test), automate the stopping of instances during off-hours and weekends.

- Policy-Driven Governance: Use AWS Config and AWS Organizations service control policies (SCPs) to enforce cost-related policies and prevent resource sprawl.

- Automated Reporting: Set up automated generation and distribution of cost reports to relevant stakeholders.

4. Financial Accountability & Collaboration: A Shared Responsibility

FinOps thrives on collaboration. It’s not just finance telling engineering to cut costs, nor is it engineering making technical decisions in a vacuum.

- Cross-Functional Teams: Foster a culture where finance, operations, and engineering teams work together, sharing goals and insights related to cloud spend.

- Chargeback/Showback: Implement models to either charge departments for their cloud usage (chargeback) or simply show them their costs (showback) to encourage responsible consumption.

- Budgeting and Forecasting: Develop accurate cloud budgets and forecasts based on historical data and future projections.

- Continuous Improvement: Regularly review FinOps practices, learn from past spending patterns, and iterate on optimization strategies.

The Cultural Shift: From Cost Center to Value Driver

Ultimately, FinOps represents a significant cultural shift. It transforms cloud spending from a perceived cost center into a strategic lever for business growth. By embedding financial discipline into every layer of your AWS operations, you empower teams to make data-driven decisions that not only save money but also accelerate innovation and deliver greater business value.

Embracing FinOps in your AWS journey is no longer optional; it’s fundamental to achieving true cloud efficiency and maximizing your return on investment.